Choosing the right health insurance plan can be daunting, especially with the plethora of options available in India. A well-chosen health insurance plan provides peace of mind and financial security in times of medical emergencies. This guide will walk you through essential steps and considerations to help you select the best health insurance plan tailored to your needs.

Table of Contents

1. Understand Your Coverage Needs

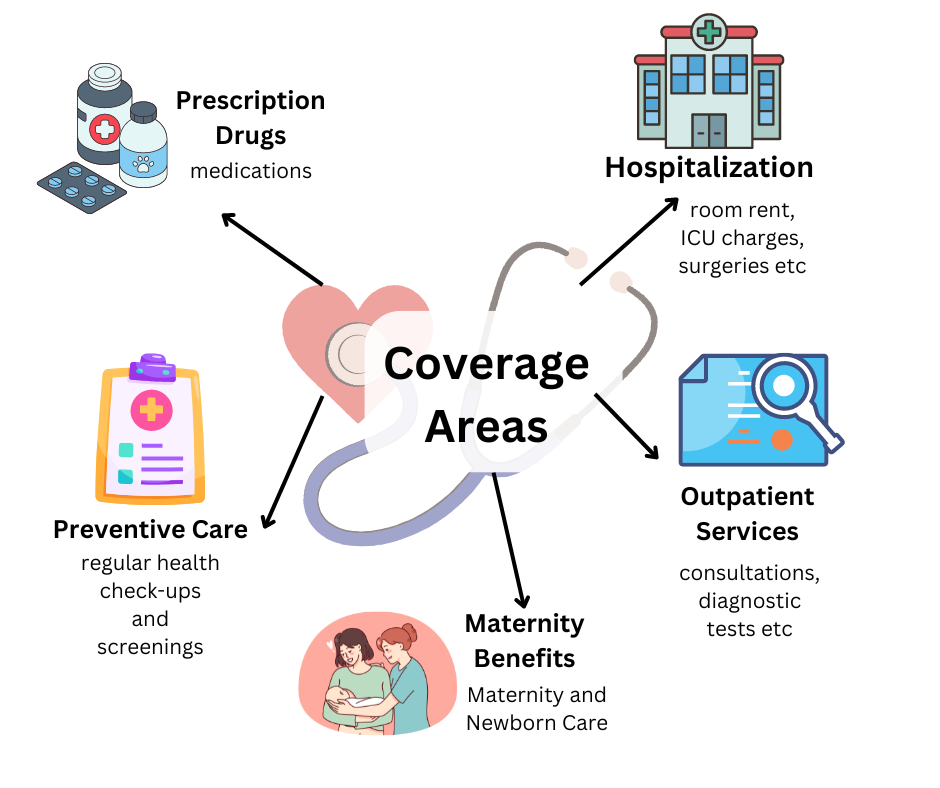

Identify Key Coverage Areas:

- Hospitalization:

- Ensure coverage includes room rent, ICU charges, surgeries, and diagnostic tests.

- Verify if there’s a cap on room rent or specific conditions tied to coverage.

- Outpatient Services:

- Check if outpatient consultations, diagnostic tests, and treatments that do not require hospitalization are covered.

- Prescription Drugs:

- Ensure that necessary medications, including chronic disease drugs, are part of the coverage.

- Maternity and Newborn Care:

- If planning a family, opt for plans with maternity benefits, covering prenatal, delivery, and postnatal care.

- Preventive Care:

- Look for plans that include preventive check-ups, vaccinations, and screenings to maintain health proactively.

Health insurance coverage

2. Evaluate Premiums and Deductibles

Understand Premiums:

- Premiums are the regular payments to maintain health insurance.

- Compare premiums across insurers for the best deal, ensuring no compromise on essential coverage.

Consider Deductibles:

- Deductibles refer to out-of-pocket expenses you pay before the insurer begins covering medical costs.

- Balance low premiums with high deductibles or vice versa, depending on your healthcare usage and budget.

Budget Balance:

- Choose a plan that fits your financial situation, especially in terms of premiums and deductibles, to avoid future financial strain.

- Tip: For budgeting guidance, check out this detailed guide on efficient budgeting.

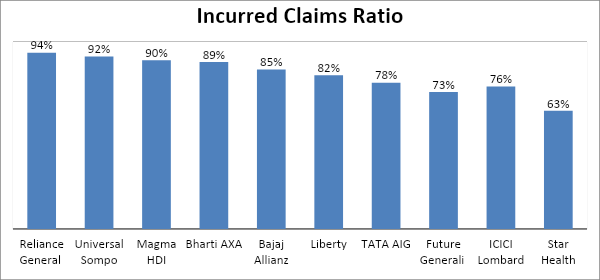

3. Assess the Claim Settlement Ratio

Why It Matters:

- The claim settlement ratio indicates how efficiently an insurer processes and settles claims. A higher percentage means better reliability.

How to Check:

- Research: Visit the insurer’s website or consult third-party insurance reviews to check the claim settlement ratio.

- Opt for insurers with a claim settlement ratio above 90% for a smoother experience in times of need.

4. Evaluate the Insurer’s Network Hospitals

Consider the Network:

- Check the insurer’s network of hospitals for geographic coverage, ensuring accessibility near your residence and areas you often visit.

Number of Hospitals:

- A large network provides more options for cashless treatments, which eliminates the hassle of upfront payments.

Check for Quality:

- Ensure the network includes reputable, multi-specialty hospitals.

- Verify if different tiers of hospitals are available, offering various levels of care.

5. Examine Additional Benefits

Look for Added Features:

- Health Coaching: Some policies offer access to health coaching services to improve overall wellness.

- Discounts: Look for additional discounts on gym memberships, wellness programs, or dietary services.

- Virtual Clinics: Check if the policy offers free or discounted virtual consultations, allowing you to speak with doctors from home.

6. Understand the Claims Process

Know the Procedure:

- Familiarize yourself with the steps for filing a claim, including what paperwork is required (hospital bills, prescriptions, etc.).

Cashless Facility:

- A cashless facility allows direct payment from the insurer to the hospital without you having to pay upfront. Ensure this service is available in-network hospitals.

- Understand the pre-authorization process, which typically requires submitting certain documents before hospitalization.

7. Seek Customer Support and Emergency Assistance

- Emergency Contact:

- Ensure the insurer provides 24/7 customer support, especially for emergencies.

- Specialist Assistance:

- Check if the insurer assigns a dedicated relationship manager or offers emergency assistance to help navigate claims and hospital admissions during critical situations.

Conclusion

Choosing the best health insurance plan in India involves careful consideration of your coverage needs, premiums, deductibles, claim settlement ratios, network hospitals, additional benefits, and the claims process. By asking the right questions and comparing options, you can find a plan that offers comprehensive coverage and fits your budget.

Remember, health insurance is not just a financial product but a crucial component of your overall wellness strategy. Make informed decisions to ensure you and your loved ones are well-protected.