Budgeting is a game-changer for personal finance. Whether you’re just starting or looking to refine your spending plan, this guide walks you through creating a budget in six easy steps. With practical tips and visual aids, you’ll learn how to save smarter and gain control over your financial future.

Table of Contents

Introduction: Why Budgeting Matters

Have you ever found yourself wondering, “Where did all my money go?” You’re not alone. In a world of subscriptions, delivery apps, and impulse buys, it’s easy for spending to slip through the cracks. That’s where budgeting comes in—a simple yet powerful tool to help you manage your money, plan for future expenses, and even make room for those “fun” purchases guilt-free.

With these six steps, you can create a budget that works for you. Let’s dive in!

Step 1: Calculate Your Monthly Income

Your budget starts with understanding how much money is coming in. Here’s how to calculate your income:

- Include steady sources: Start with your paycheck, side gig income, and any passive earnings.

- Exclude one-time funds: Avoid counting one-off payments like selling an item or a gift as part of your monthly income.

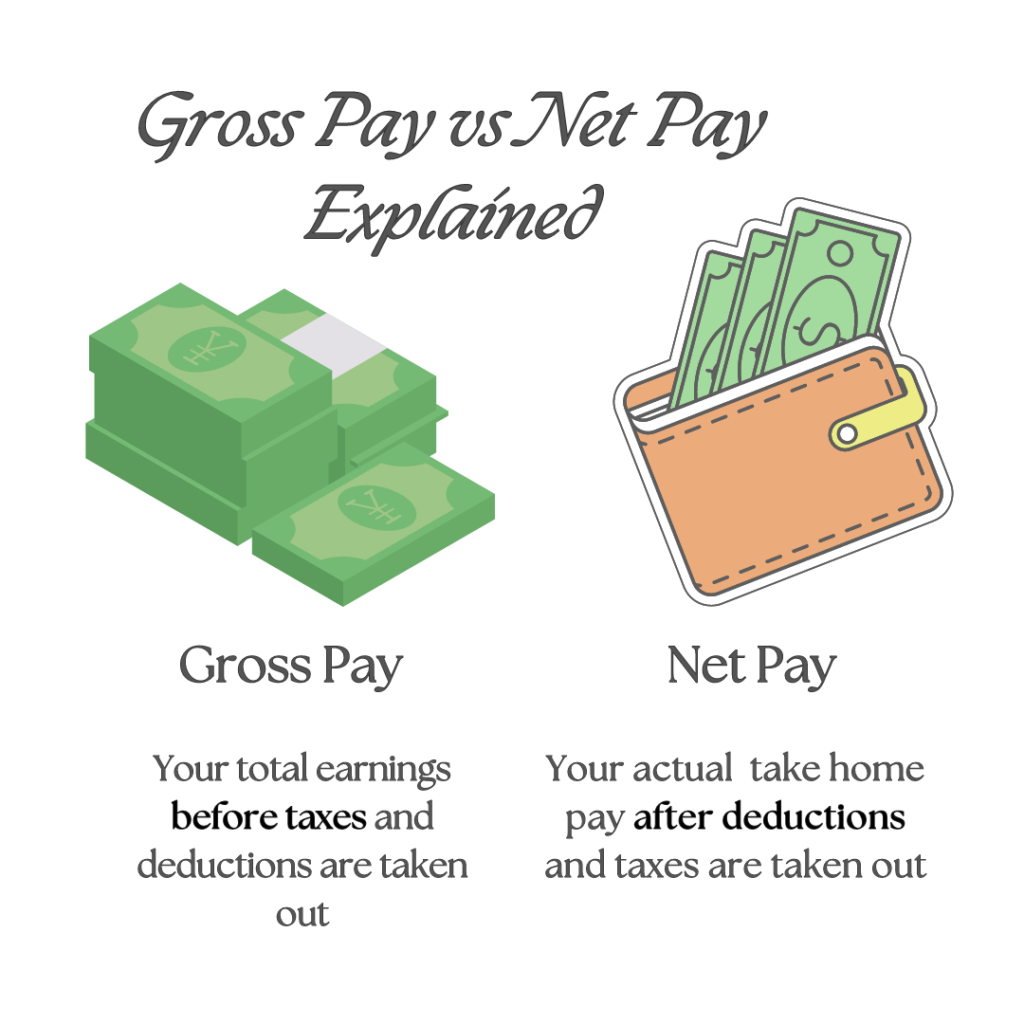

Pro tip: Always use net income (take-home pay) instead of your gross salary. This gives you a clearer idea of how much you have after taxes and deductions.

Step 2: Track Your Spending

Before you can adjust your spending, you need to know where your money is going. For this step, track your spending for at least one month.

How to track your expenses:

- Apps like Mint or EveryDollar: These tools connect to your bank and help you track spending by category.

- Manually with a spreadsheet: Log your receipts and categorize them.

- Review bank/credit card statements: Check for recurring expenses like subscriptions and utilities.

Break your spending into categories like rent, food, utilities, and non-essentials such as dining out and entertainment.

Pro tip: Don’t forget to account for annual or semi-annual expenses like car insurance or property taxes.

How to Create a Budget

Step 3: Set Your Financial Goals

This step is crucial to shaping your budget. Take a moment to define your financial goals—both short and long-term.

Examples of financial goals:

- Building an emergency fund

- Saving for a vacation or a car

- Paying off student loans

- Investing for retirement

Organize your priorities into “needs” and “wants.” This helps ensure your essential expenses are covered while also leaving room for fun, guilt-free spending.

Pro tip: Make your goals SMART (Specific, Measurable, Achievable, Relevant, Time-bound) to keep track of your progress.

Step 4: Design Your Budget

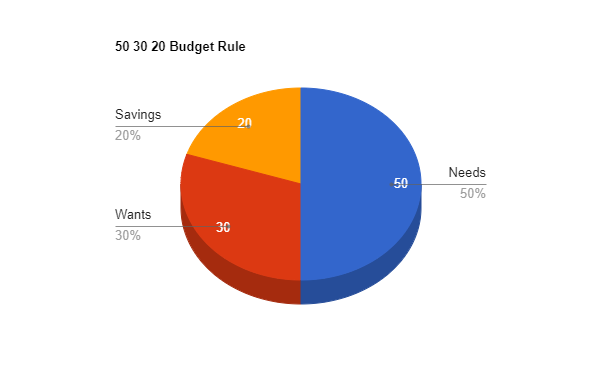

Now that you’ve tracked your spending and set your goals, it’s time to design your budget. A widely accepted framework is the 50/30/20 rule:

- 50% for needs: Rent, groceries, utilities, minimum loan payments.

- 30% for wants: Dining out, entertainment, gym memberships.

- 20% for savings: Emergency fund, retirement, or a future goal like a house.

Feel free to tweak these percentages to fit your situation. Not every budget is one-size-fits-all.

Pro tip: Pay yourself first. Set aside savings before you spend on wants.

Step 5: Track and Adjust Regularly

A budget isn’t a static document—it’s a living, breathing thing. Life changes, and so should your budget. Review your budget every month or when there’s a major life change like a new job or an unexpected expense.

Ways to stay on track:

- Set reminders to review your budget monthly.

- Use budgeting apps to receive alerts when you’re close to overspending.

- Adjust categories based on your financial goals.

Pro tip: If you notice you’re constantly overspending in one category, reallocate funds from another category or cut non-essential spending.

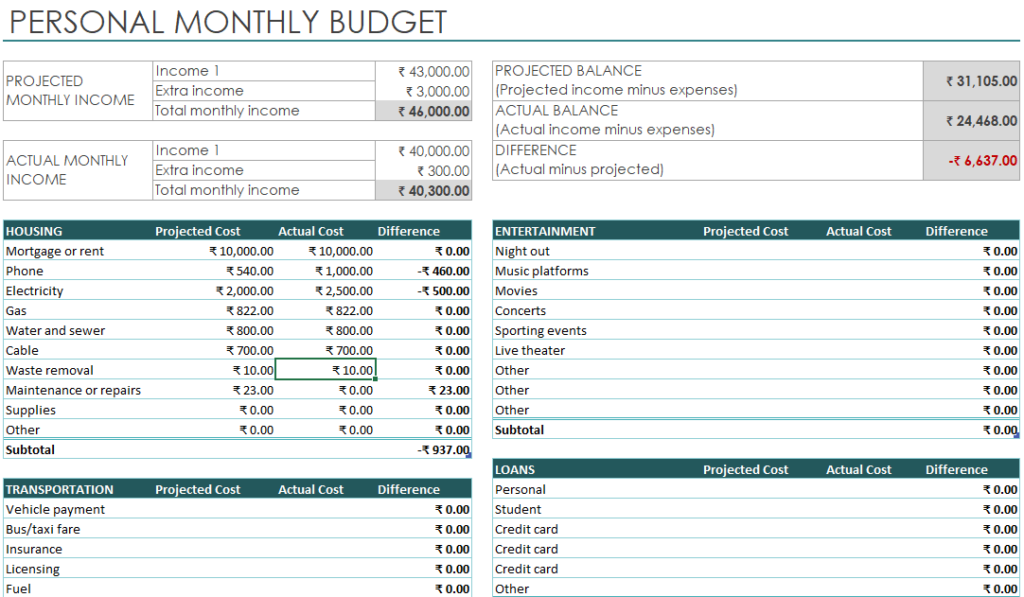

Sample Budget Tracker : You can track your expenses in this excel.

Step 6: Celebrate Wins and Stay Motivated

Finally, celebrate small victories! Saving for an emergency fund or sticking to your budget for a month is a win worth acknowledging. Reward yourself by revisiting your goals or allowing a fun splurge within your budget.

Pro tip: Regularly visualizing progress keeps you motivated. Try adding milestone trackers for big goals like paying off debt or saving for a down payment.

Conclusion: Your Financial Roadmap

By following these six steps, you’ll create a budget that reflects your needs, goals, and lifestyle. Not only will you reduce financial stress, but you’ll also set yourself up for long-term success. Now, it’s time to take the first step towards mastering your money.