When it comes to financial decisions, many people face the dilemma of choosing between a higher income and a better quality of life. Prateek Gupta and Neha Maheshwari, a couple who moved from Bengaluru to Luxembourg, offer a fascinating case study in how to make that trade-off. They swapped bigger paychecks in India for the benefits of living in a small European country, and their story provides key insights into financial planning, prioritizing lifestyle, and long-term stability.

Table of Contents

Case Study: Why Bengaluru Couple Moved to Luxembourg

In 2020, Prateek, a senior analyst at Amazon, and Neha, a finance manager for a German real estate company, decided to move from India to Luxembourg. While they could have earned more in the U.S. or Dubai, the couple chose Luxembourg primarily for the superior work-life balance and overall lifestyle benefits that Europe offers.

- Better Work-Life Balance: They wanted to experience a less stressful environment compared to what is often the case in India’s competitive job market.

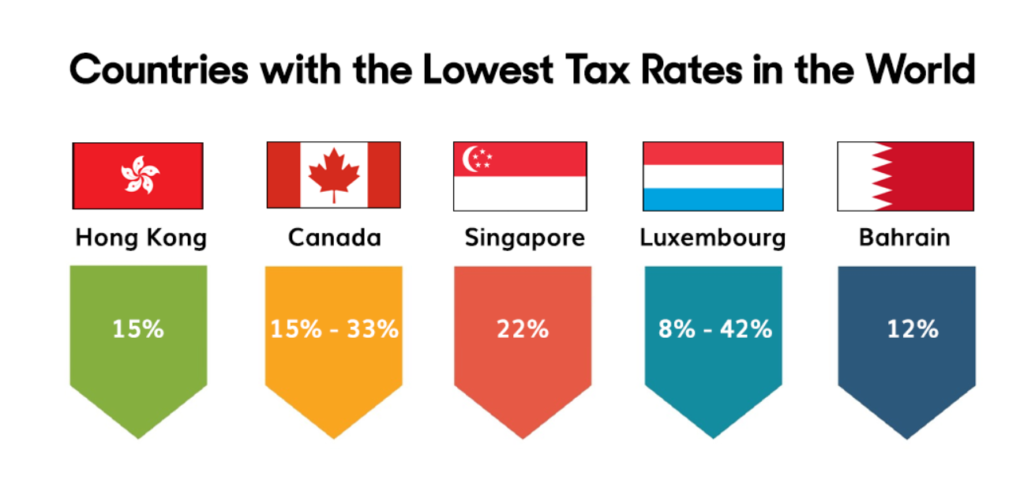

- Lower Taxes: They pay about 28% of their income as tax in Luxembourg, which is lower than the tax rates they faced in India.

- Healthcare Benefits: By contributing 3% of their income to government-sponsored health insurance, they have access to free healthcare, which provides them with peace of mind.

- Unemployment Insurance: Their 2% contribution toward Luxembourg’s unemployment fund guarantees 80% of their salary for two years if they lose their jobs.

Key Learnings from Their Decision

Their choice to prioritize a better quality of life over higher earnings offers several financial and life lessons for anyone looking to strike a balance between career ambitions and personal well-being.

1. Prioritizing Lifestyle Over Money

Prateek and Neha could have earned more by staying in India or moving to more lucrative locations like the U.S. or Dubai. However, they chose Luxembourg because it offered the kind of work-life balance and lifestyle benefits they valued more than a higher income. This shows that money isn’t the only metric of success; lifestyle factors such as mental peace, lower stress levels, and time for personal activities are equally important.

- Takeaway: Always weigh the pros and cons of financial decisions. Sometimes, a lower salary can offer you a richer life in other ways, such as more free time and less stress.

2. Understanding Taxation and Benefits

While taxes in Luxembourg are still significant at 28%, Prateek and Neha believe the services they receive, like healthcare and unemployment insurance, are worth the cost. Unlike in India, where they might have higher taxes with fewer social benefits, they appreciate the security that the Luxembourg system provides.

- Takeaway: Don’t just look at the tax rate in isolation; understand what you are getting in return. A higher tax burden can be worthwhile if it ensures healthcare, job security, and other essential services.

3. Maximizing Purchasing Power

In Luxembourg, the couple can afford luxuries like a Mercedes Benz A-Class and frequent European holidays—things that would have been out of their financial reach in India. By earning in euros and spending in a lower-cost environment, they are able to live comfortably while saving for the future.

- Takeaway: Adjusting to a country with higher purchasing power can allow you to maintain a more luxurious lifestyle while still being financially responsible. This could be an essential factor in planning any financial move.

4. Smart Financial Planning Reduces the Need for Emergency Funds

Thanks to Luxembourg’s government-sponsored benefits like healthcare and unemployment insurance, the couple doesn’t need to maintain a significant emergency fund. Their contributions to these services guarantee financial protection in case of job loss or health issues, which provides them with a sense of financial stability.

- Takeaway: Understand the financial safety nets available in different countries or systems and how they can reduce personal financial stress. This can influence how you approach saving and investing.

Final Thoughts: What Can We Learn?

Prateek and Neha’s story offers valuable insights into the importance of considering lifestyle, social benefits, and long-term stability when making financial decisions. It’s not always about earning more money; sometimes, it’s about finding a balance between income and well-being.

While not everyone has the option to move to another country, these lessons can still be applied in other contexts. For example, many cities in India offer a similar trade-off between income and quality of life. Additionally, understanding your tax system, maximizing your purchasing power, and relying on smart financial planning can make a big difference no matter where you live.

Conclusion

The decision made by Prateek and Neha serves as a reminder that life is about balance. Yes, financial success is crucial, but personal well-being and quality of life are equally important. By focusing on what truly matters—whether it’s work-life balance, lower taxes, or social security benefits—anyone can make smarter, more holistic financial decisions. So, next time you’re facing a similar choice, remember this couple’s story and the lessons it provides.

If you’re interested in personal finance and wealth building, you won’t want to miss this! : –Why Personal Finance Matters: A Beginner’s Guide to Financial Wellness